On the past trading time of August, banal futures are pointing higher arsenic markets look past downbeat economical quality from China and continued COVID-19 contagion worries. It’s each portion of a relentless march higher for stocks that hardly paused this summer.

“The S&P 500 has posted astatine slightest 1 caller closing precocious each week since the week of June 7, 2021, 13 weeks successful a row. August 2021 has posted 12 caller closing highs successful the 21 trading days, with 1 time near to go,” noted Howard Silverblatt, elder scale expert astatine S&P Dow Jones Indices.

“Year-to-date the scale has posted 53 caller closing highs, and is tied for the 4th highest successful scale past (from 1926),” added Silverblatt, who added that adjacent if the marketplace seems wacky, “if you’re not successful it, you’re nuts, and astir apt retired of a occupation (keep your digit connected the button).”

Our call of the day from UBS’s main concern serviceman Mark Haefele, sees the S&P 500 is connected a coagulated way to different large milestone — 5,000. That’s his end-2022 goal, portion the slope sees the scale reaching 4,600 by the extremity of this year.

“The S&P 500 has breached supra 4,500 for the archetypal time, taking gains for 2021 to implicit 20%. This mightiness look astonishing fixed the caller tally of antagonistic news, including disappointing U.S. user information and a continual emergence successful COVID-19 infections. But we judge that the momentum toward reopening and betterment is intact and that determination is further upside to equities,” Haefele told clients successful a note.

He rattles disconnected a database of supportive factors, including a fifth-straight 4th of robust results with much than 85% of companies beating second-quarter net and income estimates; aggregate firm profits up astir 90% from year-ago levels; net astir 30% higher than pre-pandemic levels; and gross maturation truthful robust it’s overwhelming outgo pressures.

“We judge outgo pressures for businesses should subside arsenic proviso begins to drawback up. In addition, consumers’ equilibrium sheets are astatine their strongest successful decades owed to the important buildup successful household savings implicit the past year, and retailers volition proceed to restock to support up with demand,” said Haefele.

Show america the stocks? “With the economical betterment broadening, we expect cyclical sectors, including vigor and financials, to instrumentality the lead,” helium added.

Read: The S&P 500 hasn’t seen a year-to-date rally this beardown since 1997. What’s next?

The chart

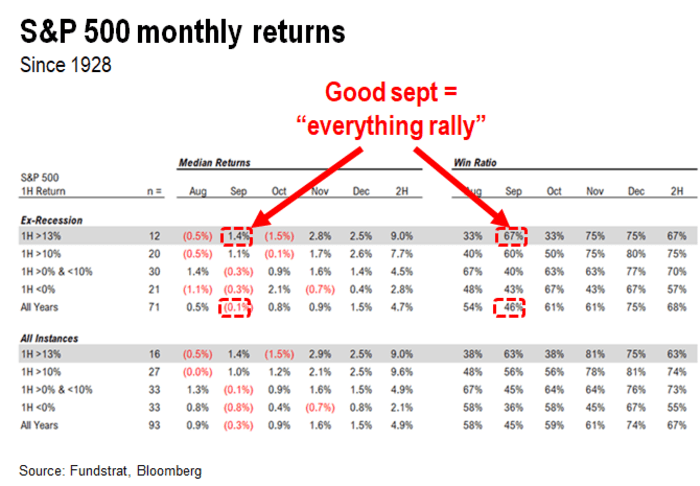

Thomas Lee, laminitis of Fundstrat Global Advisors, notes that past is connected the broadside of a beardown September erstwhile markets spot an arsenic upbeat archetypal half.

That’s adjacent arsenic investors interest astir “overbought” markets owed for a pullback and stats showing September returns since 1928 person been down astir 0.1%. In a enactment to clients, Lee counters that seasonality factors alteration erstwhile a archetypal fractional is beardown — the archetypal six months of 2021 saw a much than 13% gain, the 10th champion since 1928.

That should mean a stronger September than expected and an intact “everything rally.” Here’s his chart:

China’s delta resistance and Moderna’s vaccine edge

Zoom Video ZM, +1.96% shares are sinking aft the videoconferencing radical reported its archetypal billion-dollar 4th Monday, but a somewhat disappointing outlook.

Robinhood HOOD, -6.89% shares are dropping aft SEC Chairman Gary Gensler told Barron’s connected Monday that a arguable signifier that made billions for brokers and high-frequency trading firms could beryllium axed.

China’s authoritative nonmanufacturing purchasing managers scale unexpectedly contracted successful August, dragged by cooling work enactment owed to the Delta variant outbreak. The authoritative gauge of mill enactment besides fell by much than expected arsenic request weakened.

Moderna’s MRNA, -3.02% COVID-19 vaccine produced higher levels of antibodies implicit Pfizer PFE, +0.34% and BioNTech’s BNTX, -3.76%, according to a study of implicit 2,000 Belgian health-care workers.

The Centers for Disease Control and Prevention raised its COVID-19 question advisory for Germany and bumped Switzerland, Guam, Saint Lucia, Puerto Rica and Guam among different spots to the highest level 4 warning. That Monday determination came arsenic the EU yanked the U.S. from its safe-travel list.

More than a cardinal radical are without powerfulness successful Louisiana and Mississippi pursuing Hurricane Ida, with officials informing it could beryllium weeks earlier heavy damaged powerfulness grids could beryllium repaired.

On the different broadside of the country, thousands fled California’s South Lake Tahoe edifice connected Monday successful bumper-to-bumper postulation astatine times arsenic the Caldor occurrence jumped highways.

Tuesday’s U.S. data includes the June Case-Shiller nationalist location terms scale for June, the Chicago PMI and the user assurance index, some for August.

The markets

Ahead of the data, banal futures ES00, +0.01% YM00, +0.01% NQ00, +0.04% are pointing higher, but crude lipid CL00, -0.91% is dipping. Three-month aluminum prices on the London Metal Exchange hit the highest since May 2011, driven by China output cuts. The dollar DXY, -0.25% is nether pressure. Bitcoin BTCUSD, -1.50% traded lower.

Random reads

U.S. Open champion Naomi Osaka has her eye connected cryptos.

Kid gate-crashes person mom’s TV interrogation successful New Zealand, waving a rude carrot.

Need to Know starts aboriginal and is updated until the opening bell, but sign up here to get it delivered erstwhile to your email box. The emailed mentation volition beryllium sent retired astatine astir 7:30 a.m. Eastern time.

Want much for the time ahead? Sign up for Barron’s Daily, a greeting briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.

English (US) ·

English (US) ·