There are immoderate signs of a betterment effort pursuing Monday’s wipeout, chiefly for techs. The Nasdaq Composite COMP, -2.14% is teetering toward correction territory and the S&P 500 SPX, -1.30% and Dow industrials DJIA, -0.94% are halfway there. With jobs information looming for Friday, adjacent the bravest dip buyers whitethorn person 2nd thoughts.

Don’t look for reassurance successful our call of the day, wherever the laminitis and CEO of BullAndBearProfits.com, Jon Wolfenbarger, predicts U.S. stocks whitethorn beryllium “on the verge of starting the biggest carnivore marketplace since the Great Depression.”

“Now with the Fed talking astir tapering and wealth proviso maturation slowing

significantly from 39% y/y successful February to lone 8% y/y successful August, possibly that is

enough of a ‘tight monetary policy’ to alteration capitalist science to a more

bearish mood? We volition see,” helium said successful a Monday interrogation and follow-up comments with MarketWatch.

Wolfenbarger, who spent 22 years arsenic an equity expert astatine Allianz Global Investors, said portion he’s not a permabear — his newsletter offers strategies for profiting erstwhile markets spell some ways — investors should heed immoderate warnings signs.

Overbullish sentiment, economical weakness, excessive indebtedness levels and constricted argumentation tools are cardinal ingredients for a marketplace rout worse than that seen successful 2008-09, helium said, adding that a apical for the S&P 500 reached a fewer weeks agone could person been the start.

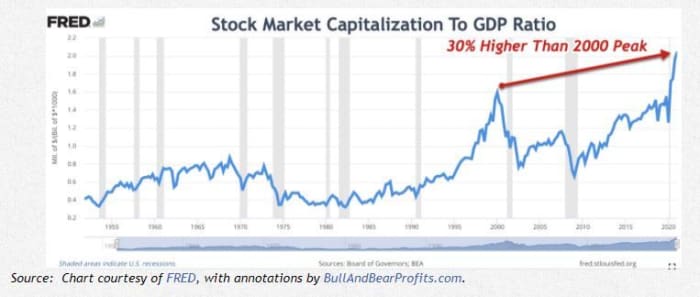

One illustration he’s watching that predicts aboriginal semipermanent banal returns — a favourite of legendary capitalist Warren Buffett, the president and CEO of Berkshire Hathaway BRK.A, -0.56% BRK.B, -0.75% — shows equities 30% supra the anterior all-time precocious seen successful the tech bubble highest of 2000.

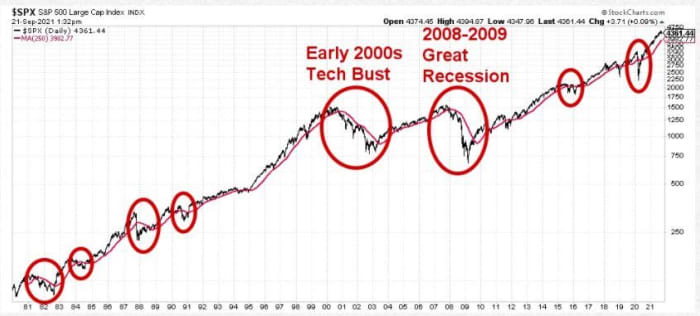

Wolfenbarger is watching S&P 500 moving averages closely. If the 250-day, presently astatine 4,020, were to “really interruption through” that could travel a large driblet for stock. His beneath illustration shows the S&P 500 terms (black line) with its 250-dma since 1980. The reddish circles bespeak erstwhile it fell beneath the 250-dma and the 250-dma slope was falling.

As for what investors should bash — Wolfenbarger advised utilizing exchange-traded funds that really spell up successful carnivore markets, which could beryllium the iShares 20+ Year Treasury Bond ETF TLT, -0.25% oregon SPDR Gold Shares GLD, +0.47%, though helium prefers inverse ETFs specified arsenic ProShares UltraShort S&P 500 SDS, +2.66% and the ProShares Short S&P 500 SH, +1.20%.

“I personally deliberation it’s easier for astir radical to conscionable bargain an inverse ETF due to the fact that it moves the aforesaid mode arsenic a mean banal and ETF, and the SH went up 89% successful the past carnivore market,” helium said, adding that SDS went up 184%.

Wolfenbarger said helium has honed his strategies aft adhering for years to Buffett’s proposal of conscionable buying and holding an S&P 500 scale fund.

“But past I started looking astatine past and you cognize it took 25 years for the marketplace to get backmost to the 1929 peak, and I don’t person 25 years,” said Wolfenbarger, who is successful his aboriginal 50s. “Any fixed concern tin spell down 50% to 90% and it tin enactment down for decades, astatine slightest 10 to 20 years.”

The buzz

The August commercialized shortage and Institute for Supply Management’s services scale for September are some connected pat for Tuesday.

The Federal Reserve has asked for an autarkic review of whether trading enactment by immoderate apical officials broke the law, a typical for the cardinal slope said.

Facebook FB, -4.89% CEO Mark Zuckerberg apologized for the outage connected Monday that took retired the website arsenic good arsenic social-media apps WhatsApp and Instagram. The six-hour outage cost him $6 cardinal personally and wiped $40 cardinal disconnected marketplace cap.

And former Facebook worker Frances Haugen volition attest earlier a Senate subcommittee, aft she said successful prepared grounds that the institution gave precedence to profits implicit safety.

Read: AMC banal fails to capitalize connected a blockbuster weekend, and meme banal traders are miffed

A assemblage has ordered electric-car institution Tesla TSLA, +0.81% to wage $130 cardinal to a Black erstwhile worker implicit a racially hostile enactment environment.

Reinsurer Swiss Re SREN, -0.33% said Hurricane Ida whitethorn person triggered up to $30 cardinal successful claims.

Farewell to Tobias Levkovich, Citigroup’s beloved and well-respected main U.S. equity strategist, who died connected Oct. 1 aft being struck by a car past month. Here’s a prescient telephone helium made successful August, arsenic good arsenic an interrogation helium kindly gave MarketWatch successful late 2019.

Check retired MarketWatch’s caller podcast, Best New Ideas successful Money, and perceive to MarketWatch caput of contented Jeremy Olshan and economist Stephanie Kelton sermon the adjacent signifier of money’s improvement with tech, wealth and concern leaders. Listen here.

The markets

Stock futures YM00, +0.52% ES00, +0.48% NQ00, +0.49% are mixed bag, with the 10-year Treasury output TMUBMUSD10Y, 1.498% holding dependable conscionable nether 1.5%, portion the dollar DXY, +0.18% is higher. In Asia, the large mover was the Nikkei NIK, -2.19%, which slid 2.1% aft Wall Street’s tumble. China markets stay closed for a holiday, and the Hang Seng Index HSI00, -2.08% ended modestly higher. U.S. lipid prices CL00, +0.99% are rising again aft surging to levels not seen since 2014.

The charts

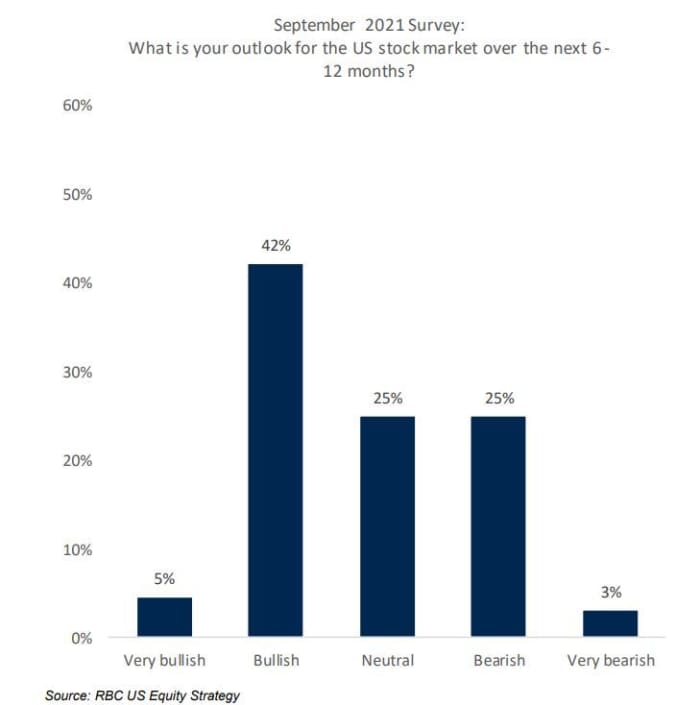

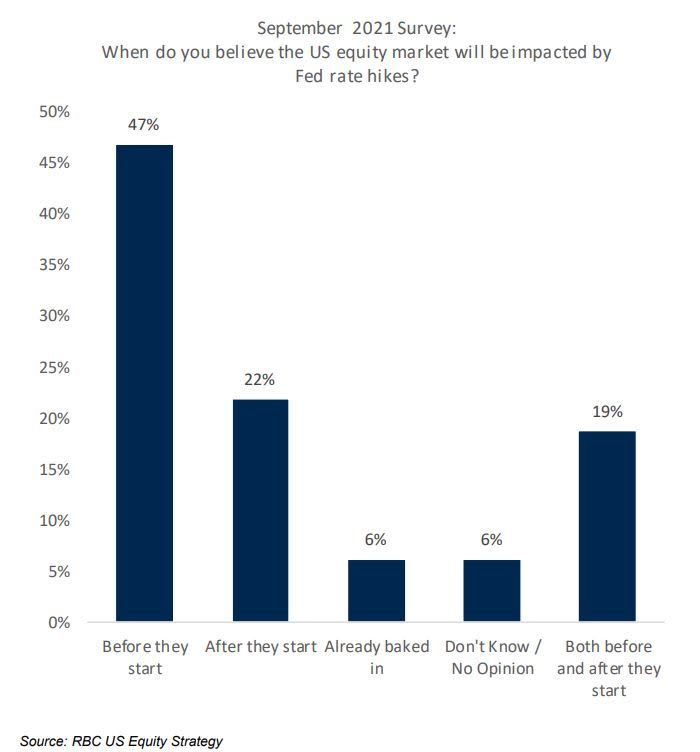

A squad astatine RBC led by its caput of U.S. equity strategy, Lori Calvasina, took the pulse of investors for September. Among their findings, a precise bearish outlook connected stocks jumped from 14% successful June to 28% successful September, “still shy of its 2Q19 high, but a crisp summation nonetheless.”

Elsewhere, astir investors spot stocks taking a deed adjacent earlier the archetypal Fed complaint increase:

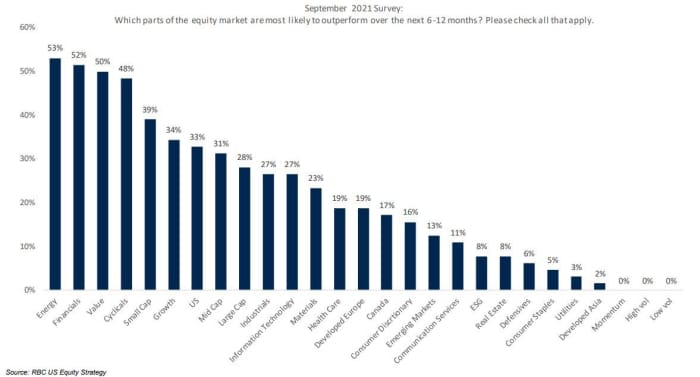

And here’s a look astatine investors’ preferred sectors going guardant successful the adjacent year:

Random read

The past roots of Halloween, traced to Ireland’s “hellish caves.”

Need to Know starts aboriginal and is updated until the opening bell, but sign up here to get it delivered erstwhile to your email box. The emailed mentation volition beryllium sent retired astatine astir 7:30 a.m. Eastern.

Want much for the time ahead? Sign up for The Barron’s Daily, a greeting briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.

English (US) ·

English (US) ·